Hello,

Happy July. 🎇

As you’ll know, I’m often mystified by what I see in the tech world. Many a global dinner table has been regaled with tales of my mystification, I like to imagine.

See, it’s easy to feel overwhelmed - even intimidated - by what we see in technology. We are led to believe that if a company is “valued” at some exorbitant number, they must be doing something right. All of the language and imagery are designed to create awe.

I’d like to say I’ve overcome this and metamorphosed into a Nietzschian Übermensch, ready to dish out reality in limpid prose. Actually, I fall into the same traps.

I’m building my own startup, Novela, and I am perhaps excessively simplistic about things. I want to, you know, bring in money from happy customers and use that money to make the product better and then find more soon-to-be-happy customers. (Do get in touch if you’d like to know a little more, by the way!)

It doesn’t seem like this is how tech businesses function these days, and I find it difficult to understand how some of them remain a going concern. But, I assume somebody must know what they’re doing, right? It’s probably some complicated financial model I can’t understand.

Except sometimes, they really are just chancers. Other times, they’re worse.

I’ll be looking at a couple of such businesses, my detective hat askew and my monocle firmly in place, in today’s edition of hi, tech. 🧐

However, we shouldn’t forget that these companies only operate in the way they do because that’s what the system rewards. They aren’t doing it out of an ideological commitment to the grift. L’arnaque pour l’arnaque, as the French might say but never actually did.

One cannot help but be reminded of Cicero’s turn of phrase: “Politicians are not born; they are excreted.”

One could say the same of the so-called unicorns, if you’ll forgive the imagery.

First up: Byju’s.

What’s Byju’s?

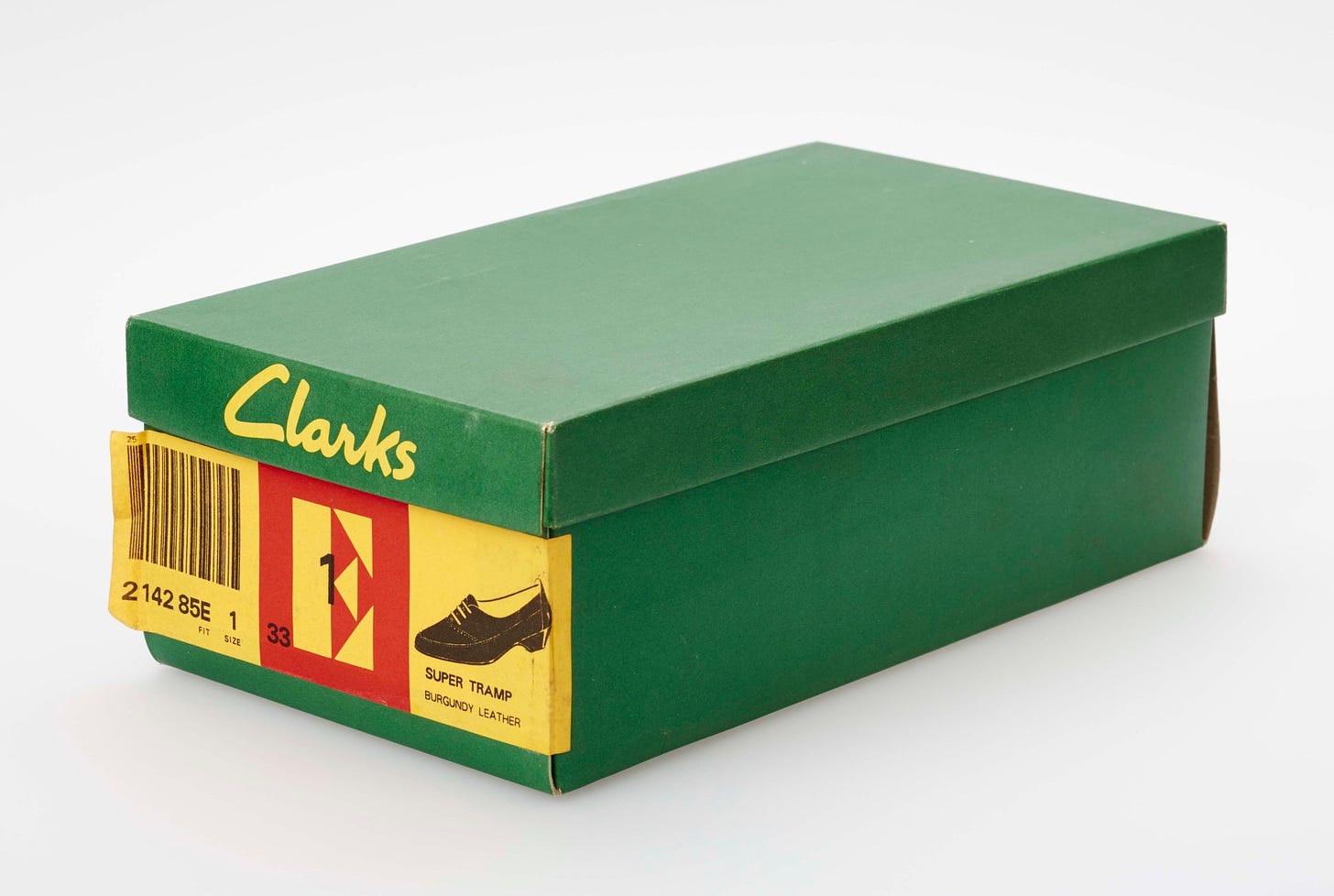

Given how big they are in India, it’s surprising how little-known Byju’s is - in Europe, at least. They sponsor all manner of sporting events, including the 2022 World Cup, and they’re all over Indian cricket.

The most common theory I’ve heard among European sportswatchers is that it’s probably something like Wish.com. They could Google it, sure, but where’s the fun in that?

Founded in 2011, Byju’s is an e-learning platform. It is backed by Mark Zuckerberg (*alarm bells ringing*) and it was started by Byju Raveendran and Divya Gokulnath. Yes, he named it after himself. Is anyone surprised? Honestly, that should have been enough to scare everyone off.

I’m just imagining if my partner and I started a business and I called it Clark’s. It wouldn’t happen, and not just because some shoe company already owns the company name.

Byju saw how big the e-learning opportunity could be while he was teaching maths to schoolkids in sports stadiums. Yes, 25,000+ kids were attending stadiums to learn their algebra. He figured, not incorrectly, that he could reach even more people by going digital.

The company secured big-name backing from international investors within its first few years, then expanded very aggressively within India.

>75% of Byju’s self-reported income still comes from India, but it has partnered with Disney to enter the US market:

Byju’s has been a significant promoter of the horrific “phygital” portmanteau, but basically it believes in the “blended” learning experience. As the Disney image shows, the child works with a standard notebook but they also have an iPad-style device that gives guidance.

You’ll notice the little red clip-on appendage on the iPad in the image. Byju’s bought Osmo for $120 million; the latter creates computer vision technology that can view the child’s workbook and assess their progress.

They claim to have over 150 million students today and the focus on school-age children. There are 1-on-1 tutoring sessions, classes, and supposedly “personalised learning paths”.

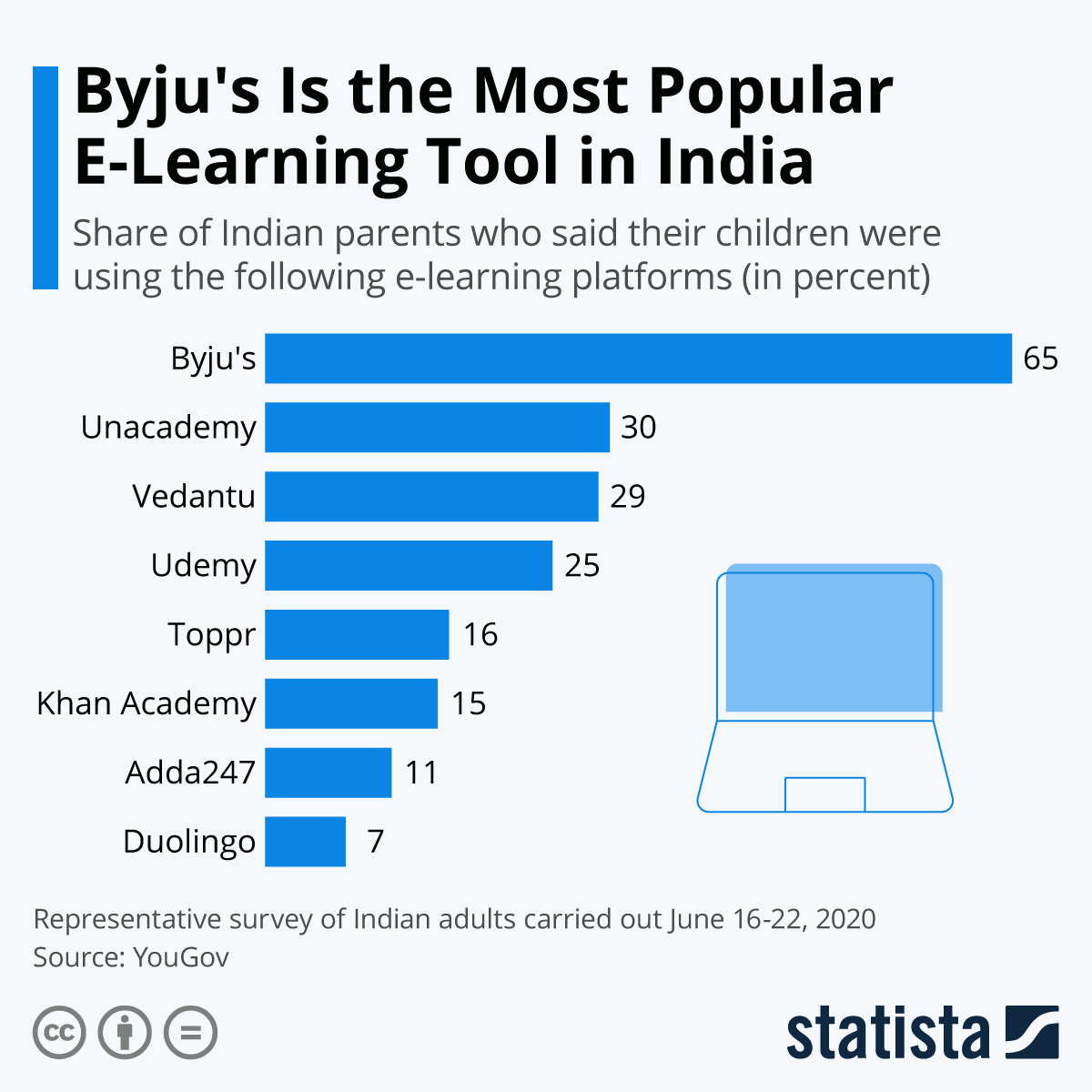

I have always struggled to get a grasp on how they can possibly justify a valuation of >$20 billion. It had over 58,000 staff in 2022 and in its last financial records (FY21), its losses were more than double its annual revenues. Those revenues were estimated at roughly $630 million at the time.

We still don’t know what the figures are for FY22, which brings us to the apex of this story.

The recent scandals:

So, Byju’s has taken a leaf out of the standard “blitzscale” VC playbook. It took on a huge amount of investment (Crunchbase reckons over $6bn of the stuff) to try and seize control of a nascent, tech-driven market. Like a lot of businesses, it somehow assumed that the pandemic trend of “online-first everything” would continue.

Instead, it has found itself in a vicious cycle. It continues to take on more investment to try and chase its losses in a shrinking market. The company is now trying to cut costs, which reduces its capacity to grow its revenues, all while its interest payments to lenders swell.

Things must be gloomy: Byju’s own auditor, Deloitte, resigned because the former wouldn’t share its financial records for FY22. And most recently, every non-family member of the Byju’s board stood down. The company’s new valuation is closer to $5bn, and that’s before we see how it’s really doing. The company says it’ll get round to filing those records in September.

The signs were all there, nonetheless. But there’s more money to be made inflating a bubble than bursting it.

For example Byju’s has used “questionable” sales tactics - here’s the opening of just one 2022 article:

”India’s federal child rights commission has accused the country’s biggest online education company, Byju’s, of harassing parents and their children through cold-calling and threatening and forcing them to subscribe to their courses.”

I say “questionable”, but these ethics would raise eyebrows in the court of Caligula.

Byju’s was buying the phone numbers of parents - and when it could, the phone numbers of children - to harass them into subscribing. Parents then ended up with unexpected, exorbitant bills. One victim posted on Twitter, “I've decided now to expose Byju's fraud to every parent".

Another shared their Byju’s experience:

“After taking up the online classes with Byju's my daughter has a lot of mental pressure, which is also taking a toll on her health. I tried cancelling the subscription but of no use.”

And then the staff got involved - one posted on social media:

“I remember skipping meals because of the pressure and torture... if the unrealistic goals weren’t achieved, they would ask us to resign in the next 15 days.”

They’ve been doing more than asking people to resign recently, too. The company was under fire in October 2022; in the same month it hired Leo Messi as a global ambassador (when has he ever turned his nose up at grubby money?), it fired 3,500 staff. Priorities, eh?

Things are so bad today that one employee says, "Right now, the situation is so dismal, subordinates are sitting with their managers and job hunting."

No-one knows how many staff remain, but the running estimates put it below 25,000 now. The company has defaulted on some loan repayments and is now suing some of its New York creditors.

What this all means for Byju’s and EdTech:

I’m slightly more sympathetic to this individual company than it might seem. I’ve been reading about it a lot and the word “pressure” is prominent.

A former Byju’s executive said recently, “Byju could never say no to more money, even when it was not needed. Greed took over.”

I wouldn’t seek to explain away their toxic work culture or horrendous sales tactics. However, I can see how a company gets caught in this trap and cannot get out. I have met casually with a few VC types over the past few years and we talk a little about my Novela business, although I’m always very distant about it.

The VC people of course tell me how I’m not solving a “VC problem”, not that I asked. I have to see it as being worth many, many billions to get their investment. If I did want their investment, it’s easy to see how I would get it. Tell them what they want to hear.

They do know most of these founders will turn out to be wrong; they just need one to tell the truth, whether by accident or otherwise. That will handsomely pay for all the failures along the way.

I can see why other people are inclined to play this game, in the hope of figuring out the details later and making the business model work. And once you’re in, you’re in. The pressure mounts. Pressure makes people do quite awful things.

To my mind, one huge problem for Byju’s was that education and the traditional VC growth model have contrasting purposes. VCs want to treat education in the same way they would treat “disrupting” the hotel industry, or dating, or sports apparel.

That explosive growth in users can hardly align with substantive education. It is also not how people make decisions about their education, hence the ridiculous pressure from Byju’s on its own salespeople and customers to try and bludgeon their products into a VC-friendly sales cycle.

There are questions about corporate governance now too, but in reality nobody was looking into Byju’s before it all went really wrong. I wasn’t even writing this article.

Some very serious investors got involved in Byju’s, including Sequoia Capital (of course) as well as the Chan Zuckerberg Initiative. These are influential institutions who can sell a story to the media, all in the name of shoring up their investment - and hopefully selling it to someone else at a profit in the future. Any questions can have a damaging ripple effect, since the whole thing is ultimately a house of cards.

This status quo might be set to change, out of necessity. Rising interest rates mean VCs can’t get hold of cheap money to fund cash-burning start-ups. For now. I don’t believe any systemic lessons have been learned through this process, though.

So we will have some talk about “fundamentals” and a realistic path to profitability, but the incentives are still there to attract the next Byju’s.

On that note:

Google Accused of Deceiving Advertisers Over Video Ad Placements

A new report finds that:

”Advertisers including Fortune 500 brands, the US federal government, and many small businesses may have been misled for years about Google’s proprietary TrueView skippable in-stream video ads. This misalignment may have cost media buyers up to billions of digital ad dollars, which were ultimately spent on small, muted, out-stream, auto-playing or interstitial video ad units running on independent websites and mobile apps.”

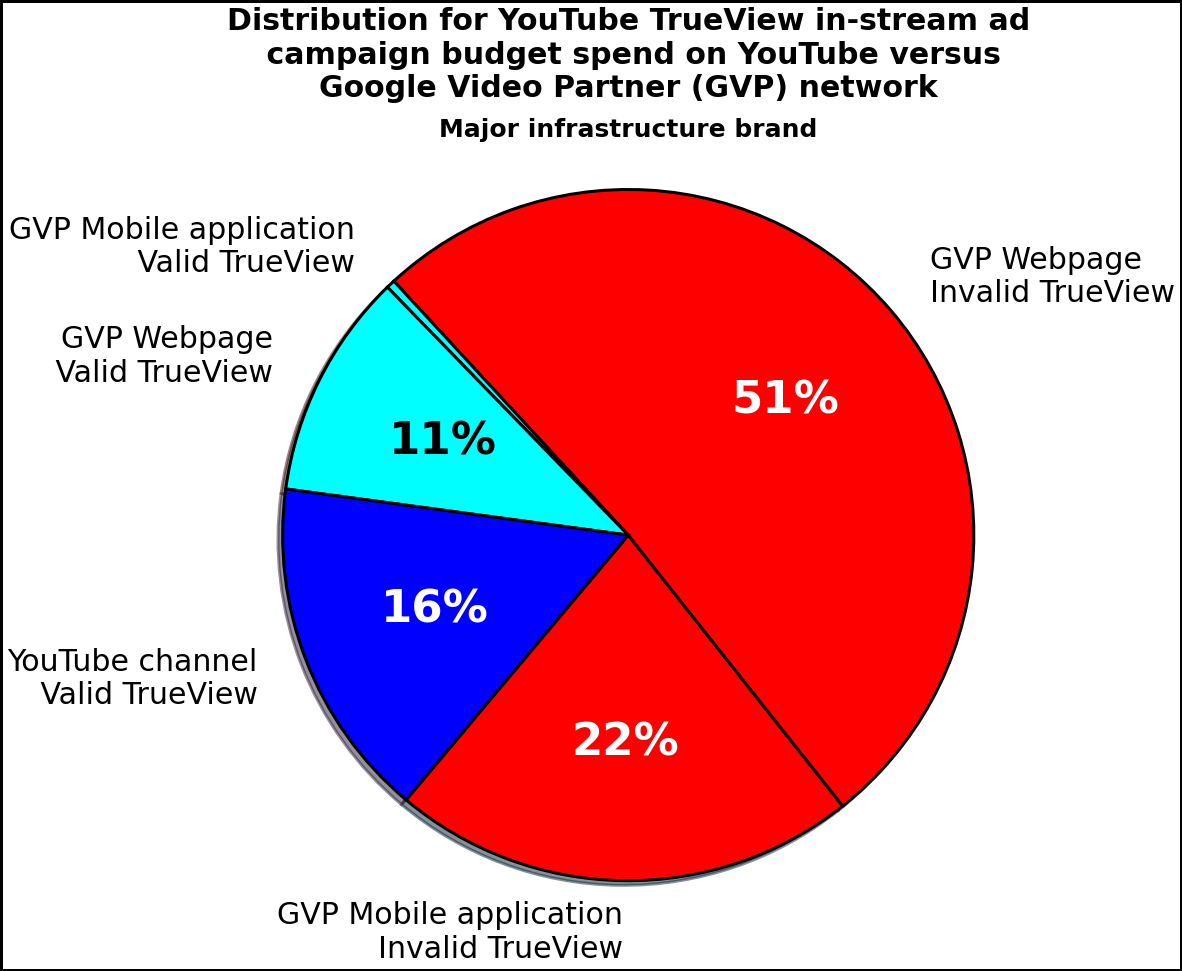

The report shares examples of huge brands, for whom only 16% of their video ads were running on sites that met Google’s own quality standards. On average, they reckon most brands are misled about 80% of their video ad spend.

And as we move towards the black box of “Performance Max”, this will only get worse.

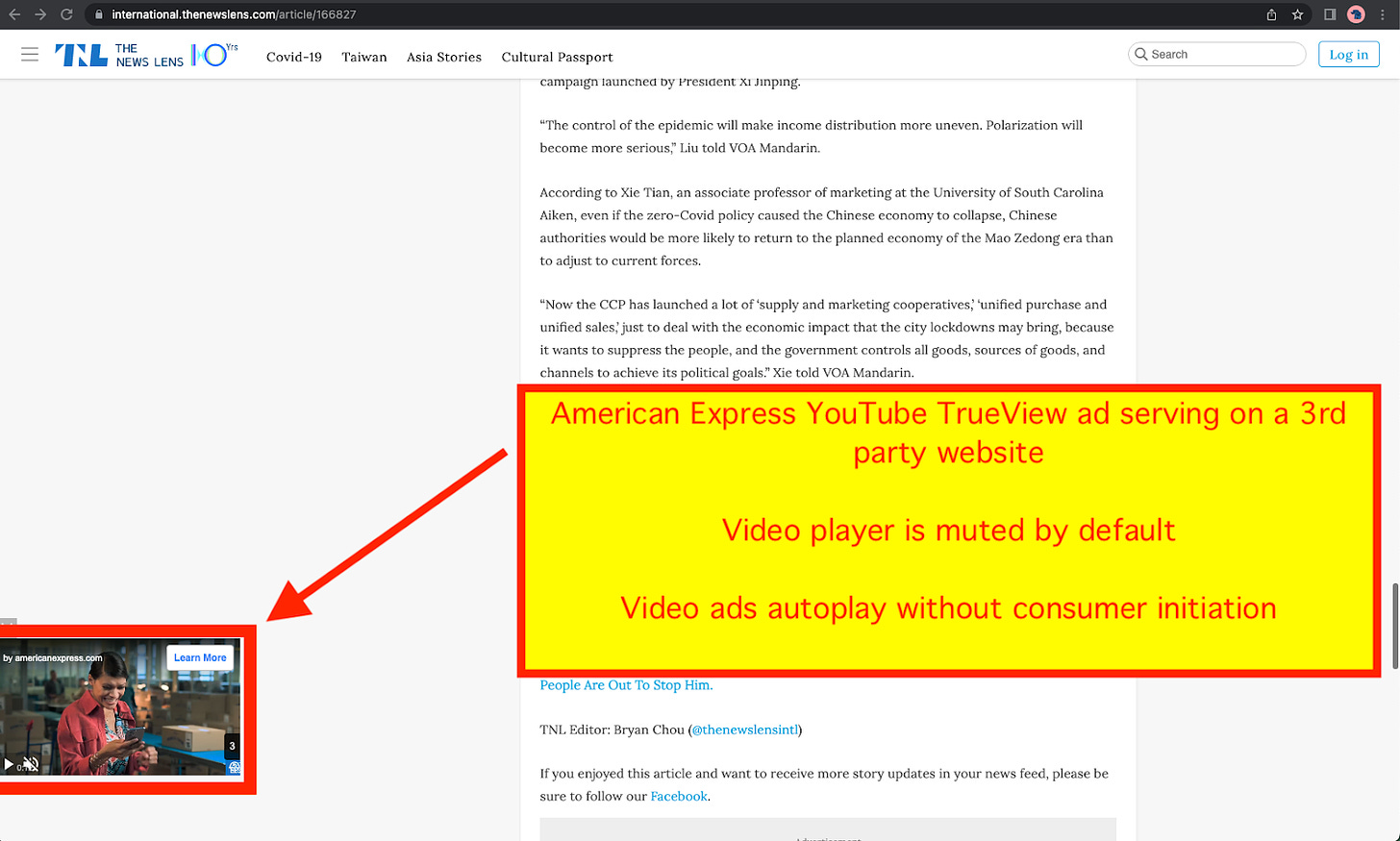

Here’s how one American Express ad was running, when the brand thought it was running full-screen on YouTube:

Apparently, “This discovery has sparked outrage among advertisers who were under the impression that their ads were being displayed in safe and reputable digital environments.”

Were they? I understand that they are the victims here and Google’s monopoly leaves them with few alternative advertising options, but I’d be surprised if anyone in-the-know were clutching their pearls over this. It’s a swindle that’s been hiding in plain sight for over a decade now.

Hey, It’s Not All Bad! 😎

They think they’ve found a picture of an ancient pizza in Pompeii:

They didn’t have tomatoes, but it does look like some sort of flatbread dish. And a previous discovery found what looked like a proto-pizza parlour, too. 🍕